General Member Blog Posts

Using Commercial-Grade Electric-Assist Cargo Bikes for Last-Mile Deliveries

The idea of using commercial-grade electric-assist cargo bikes for last-mile deliveries in urban settings has gained momentum in the EU, particularly in the bicycle-dense Netherlands and cities such as Rotterdam, Amsterdam, and Utrecht. While we are a US-based industry organization, these markets have been influential in terms of organization, deployment, and regulations.

From a business perspective, commercial cargo bikes, supplemental cargo trailers, and various grades of electric assist are components of a broader picture. They are important but not the sole factors in the success of the business model.

Defining the Cargo Bike

According to a 2023 report by ARUP and Tour de Force for the City of Rotterdam:

“Cargo bikes are, often electrically powered, bikes specifically designed to carry loads, making them suitable for deliveries in the city. These are deliveries of goods and services.”

The variations in cargo bike types, sizes, features, and platforms are designed for specific tasks or to navigate particular terrains. For the North American market, some designs differ from acceptable standards and regulations, but all aim to serve a commercial purpose.

Environmental and Business Objectives

In the EU, environmental objectives have significantly influenced regulations, incentives, and business goals. In contrast, North American geopolitical positions often prioritize business objectives over environmental ones. While zero-emission zones have altruistic goals, the primary driver for US investors is to deliver goods faster and at a lower cost per item than traditional gas-powered vehicles, especially in congested traffic.

Infrastructure and Challenges

In the US, cargo bikes, on-demand ridesharing bikes, and scooters benefit from designated bicycle lanes, which often consist of a simple painted line. However, delivery vehicles frequently obstruct these lanes to load and unload, viewing bike lanes as encroachments on space meant for cars or as competition.

Business Models

The business model for cargo bikes supplements traditional ridesharing bikes, similar to how car rentals offer pickup trucks and SUVs for transporting people or goods. Commercial last-mile delivery models fall into two types: transporting goods from multiple vendors to multiple buyers (e.g., food delivery) and from a single-point distribution warehouse, often with repetitive routes for restocking supplies.

Report Insights

The 106-page report categorizes the use of electric-assist cargo bikes into three aspects: the journey, the user type, and the area type. These categories help municipalities understand the daily challenges faced by cargo bikes. The report highlights steps in the journey, such as loading/unloading, parking, charging, and transitioning between driving and standing still. User types vary based on the products being delivered, from e-commerce packages to service and support. Area types range from dense urban streets to suburban areas without sidewalks.

Municipal Policies and Investor Considerations

Municipal policymakers view last-mile cargo delivery permits as a financial double-edged sword, generating revenue but also incurring expenses for creating bike lanes, parking spaces, and safe charging systems. Investors face capital expenses, including storage and maintenance facilities, repair tools, consumables, and software for tracking equipment and inventory.

Regulatory and Safety Considerations

Regulations, such as the number of wheels on a bike, impact business models. In the US, bicycles are defined as one-, two-, or three-wheeled vehicles, with four wheels classifying them as cars subject to additional regulations. Safety certifications for rechargeable batteries and electric drive systems are also becoming mandatory in contractual agreements with municipalities.

Opportunities and Challenges

The report outlines opportunities for cargo bikes stemming from changes in consumer shopping behavior, especially since the pandemic, with a growth in online shopping and demand for fast deliveries. Cargo bikes fit well into this environment, and their popularity in logistics and urban areas is expected to grow.

Practical Considerations

The report details the logistics timeline for cargo bike riders, space allocation for parking and charging solutions, and functions associated with short and long stops. It also addresses scenarios where riders store and charge cargo bikes at their residences and emphasizes the need for a full e-commerce package tracking system with GPS hardware and optimized routing software.

Community Engagement and Infrastructure Planning

Gaining community buy-in involves working with local retailers and national e-commerce brands for potential partnerships. The report’s emphasis on developing a cargo bike program within the EU offers insights applicable to North American business plans and community proposals, including planning and engineering public thoroughfares to incorporate cycling infrastructure.

Learning More About Building A Cargo Bike Business Model

On Thursday, December 5, 2024, Micromobility Business will be hosting a Global Online Summit with many experts presenting great discussions on the business side of fleet-based ridesharing programs and commercial, last-mile cargo opportunities. Visit the section on the conference here >>

Access the Report

This comprehensive report provides extensive details and can be downloaded [here].

The US Is Setting Micromobility Usage Records With A 20% Increase Annually, But All Is Not Rosy

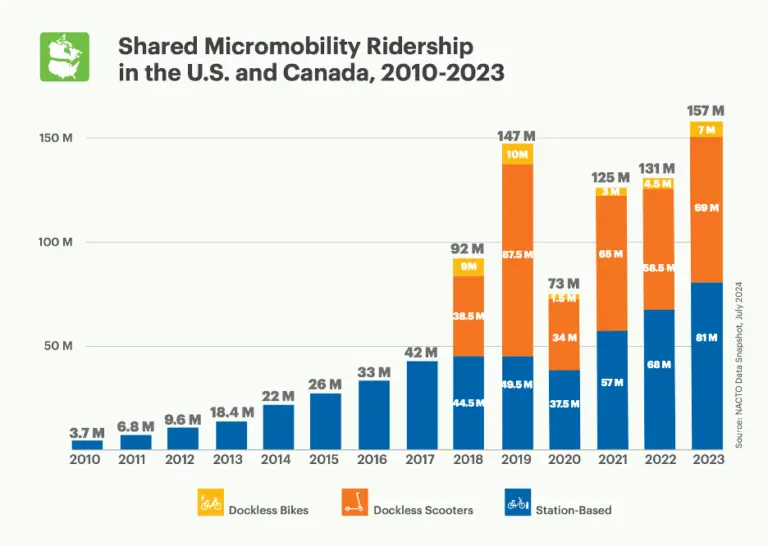

In a recent article by Kea Wilson of Streetsblog USA, it was reported that the number of trips on shared micromobility devices, such as electric bikes and scooters, saw a significant 20% increase from 2022 to 2023. However, the report also indicates a concerning trend: many of these operators may struggle to survive without financial support from local governments.

Wilson’s research highlights that North America set a new record for the number of micromobility trips in a single year, with Canada experiencing an impressive 40% increase in usage. Despite this growth, the National Association of City Transportation Officials (NACTO), which provided the data for Wilson’s article, warns that the industry is facing a precarious situation. Without local government subsidies, many service providers could go out of business, potentially leading to higher annual pass rates for riders by 20 to 30 percent, even in major programs.

NACTO emphasized, “Shared micromobility is at an inflection point. It is imperative that cities design durable operational models to ensure the long-term viability of this increasingly relied-on transportation mode.”

The report suggests that there isn’t a single cause for the micromobility sector’s vulnerability, despite the rising demand for alternatives to car usage. Notable challenges include significant layoffs within the rideshare industry, such as at Bird, and the withdrawal of major sponsors from publicly supported systems.

Additionally, the report notes that maintenance and repair costs have increased due to the growing number of electric-assist bikes and scooters in fleets. These expenses contribute to rising rates for riders, which in turn impacts ridership volumes.

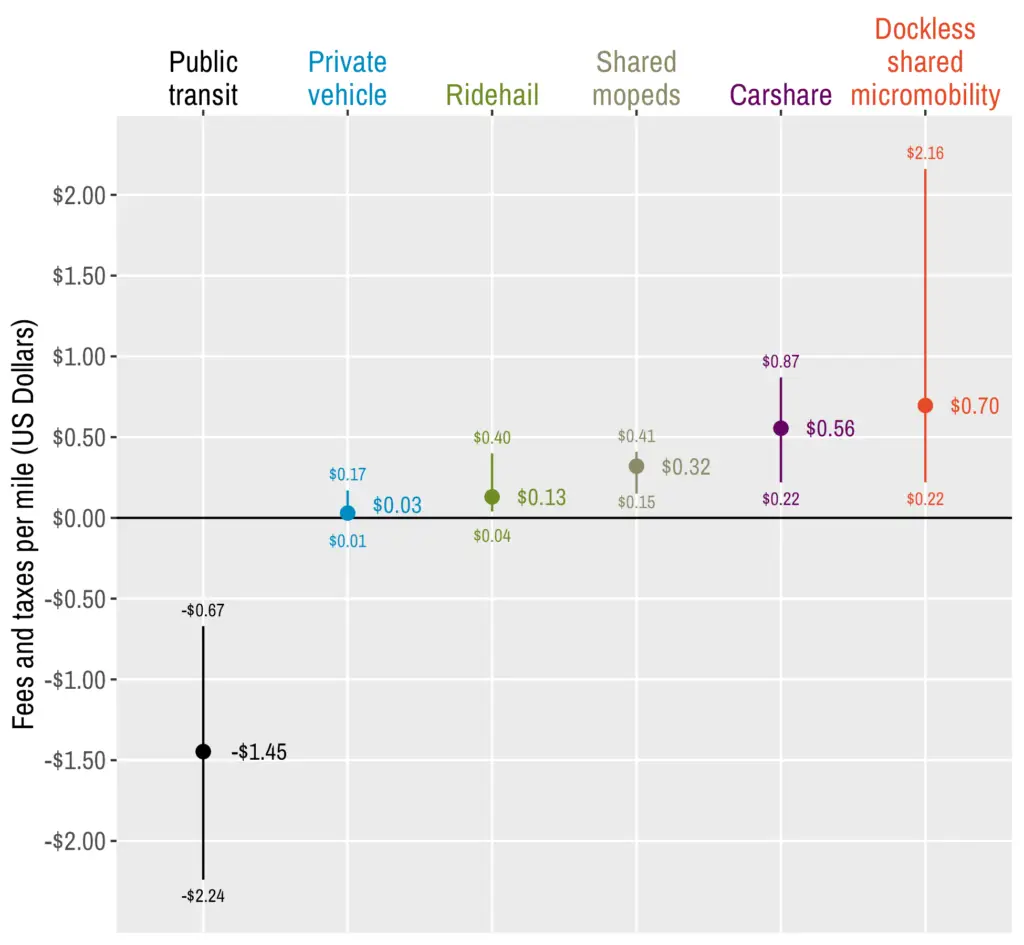

A separate study by Portland State University, Sonoma State University, and the bike-share company Lime found that taxes on a per-mile basis for micromobility products are 23 times higher than those for cars. The study shows that more than a third of a million dollars is collected annually in fees as revenue for municipalities, with an average of 16.4% of each ride’s cost going to taxes and fees.

For comparison, the study found that private vehicles incur charges of $0.03 per mile, taxis/ride-hail services $0.13 per mile, shared mopeds $0.32 per mile, and ride-share bicycles $0.70 per mile.

Some cities have eliminated permit fees in favor of increased per-mile fees, aiming to create a more collaborative relationship with vendors. However, in Europe, some vendors have had to navigate challenging qualification processes, often over-promising to secure selection.

This combination of permit fees and usage charges is seen by some as double taxation, raising concerns within the industry. Many communities use this revenue to offset budget shortfalls, dedicating only a small portion to improving protected cycling infrastructure. While there is an emphasis on supporting lower-income neighborhoods through incentives, the rising costs of maintenance, fees, and taxes ultimately impact all consumers, regardless of income level.

New Subscriber Registration | Subscriber Login | Subscriber Dashboard | Password Reset